The surge in remote work has dissolved traditional geographic boundaries, enabling African talent to provide services to companies worldwide. However, this borderless workspace also introduces the complex challenge of receiving payments across different countries and currencies. For African remote professionals who are part of this digital revolution, navigating the labyrinth of global payment solutions can be daunting. This guide aims to demystify the process, presenting hassle-free payment options that cater to the unique needs of African freelancers and remote workers.

Understanding the Payment Landscape for African Remote Workers

The African continent is a mosaic of diverse economies, each with its own financial regulations and infrastructures. As a result, remote workers require payment solutions that are not only secure and reliable but also adaptable to various African financial environments. Traditional bank transfers, while familiar, often come with high fees and prolonged processing times, which are not conducive to the fast-paced nature of remote work.

The Rise of Digital Wallets and Mobile Money

Digital wallets and mobile money services have revolutionized financial transactions in Africa. Platforms like M-Pesa, Airtel Money, and EcoCash are leading the charge, offering swift and cost-effective means to send and receive money. For remote workers, these services provide the convenience of direct transfers to their mobile devices, bypassing the need for a bank account altogether. Companies hiring African talent can leverage these mobile money platforms to facilitate smooth payment transactions, ensuring timely compensation for services rendered.

Cross-Border Payment Platforms: Bridging the Gap

To address the challenges of cross-border payments, a number of global payment platforms have emerged as frontrunners. Services like PayPal, Payoneer, and Skrill offer solutions that are specifically designed to handle international transactions. They provide features such as currency conversion, lower transaction fees, and the ability to withdraw funds to local bank accounts or cards. For African remote talent, these platforms are a gateway to seamless financial interactions with international clients.

Cryptocurrency: The New Frontier in Payments

Cryptocurrency is steadily gaining ground as a viable payment option for remote workers. With its decentralized nature, digital currencies like Bitcoin and Ethereum eliminate the need for intermediaries, offering faster transaction speeds and reduced costs. Additionally, the security and transparency of blockchain technology make cryptocurrencies an attractive alternative for African professionals seeking autonomy over their earnings. As the crypto ecosystem continues to mature, it represents a burgeoning opportunity for remote workers to engage in the global marketplace.

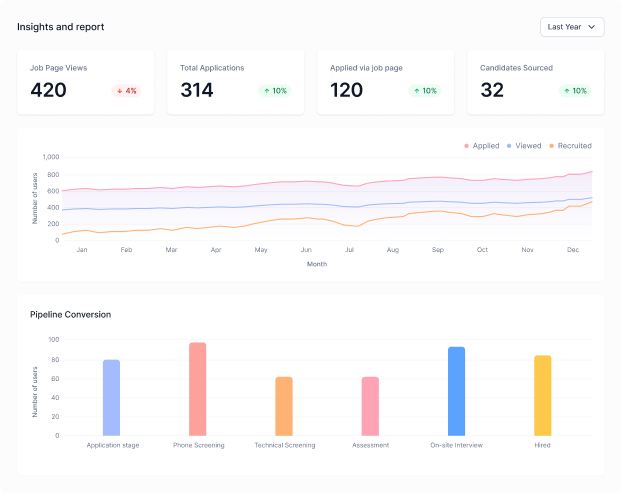

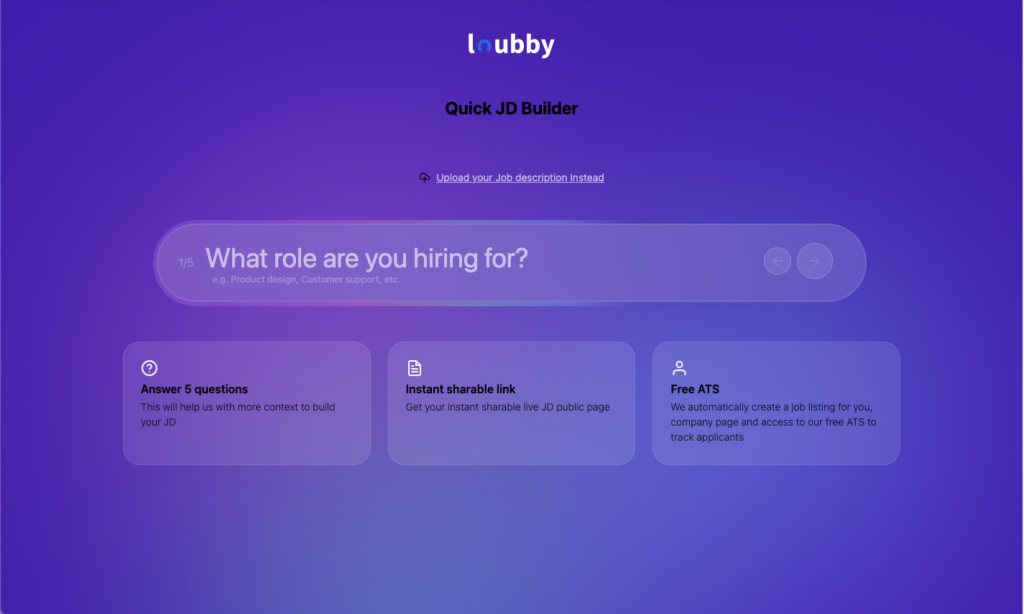

Loubby AI: Integrating Payment Solutions for Remote Teams

Enter Loubby AI, a comprehensive HR tool designed to manage remote teams effectively. Loubby AI recognizes the payment challenges faced by remote workers and integrates various global payment solutions into its platform. This integration allows employers to effortlessly process payments to their African remote talent, ensuring that the right amount reaches them on time and in their preferred currency. With Loubby AI, African professionals can focus on delivering quality work, confident that their payment needs are being expertly managed.

Choosing the Right Payment Solution

When selecting a payment solution, African remote workers should consider factors such as transaction fees, exchange rates, ease of access, and the reputation of the service provider. It’s essential to conduct thorough research and read reviews from other users to make an informed decision. Additionally, remote professionals should always be vigilant about online security and protect their financial information from potential scams or fraudulent activities.

Navigating Regulatory Compliance

Compliance with local and international financial regulations is another critical aspect of selecting a payment solution. African remote workers must ensure that their chosen platform adheres to the legal standards set forth by their country’s central bank and other relevant authorities. This compliance not only legitimizes their earnings but also safeguards them against legal repercussions that could arise from the misuse of financial services.

Building Trust with Employers

African remote talent must also establish trust with their global employers when it comes to payments. Clear communication about preferred payment methods, schedules, and any potential issues that may arise with cross-border transactions is vital. By being proactive and transparent, remote workers can foster strong working relationships and ensure consistent payment practices.

Staying Ahead of the Curve

The payment solutions landscape is continuously evolving, with fintech innovations emerging regularly. African remote workers should stay informed about new platforms and services that could offer more advantages in terms of cost, speed, and convenience. Subscribing to fintech news sources, joining professional networks, and participating in forums can keep remote professionals ahead of the curve and open to adopting cutting-edge payment solutions.

The Role of Financial Literacy

Financial literacy plays a significant role in managing global payments effectively. African remote workers should equip themselves with knowledge about currency exchange, tax implications, and financial planning. Understanding these concepts can help maximize their earnings and make strategic decisions regarding their financial health.

KEY TAKEAWAY

For African remote talent, the world is truly at their fingertips, and getting paid should not be a bottleneck in their journey to global success. By leveraging the right mix of digital wallets, cross-border payment platforms, cryptocurrencies, and integrated tools like Loubby AI, African professionals can navigate the complexities of global payments with ease. As the demand for remote work continues to grow, the ability to manage financial transactions efficiently will become increasingly important. With the right payment solutions in place, African remote workers can ensure that they are compensated fairly and promptly, allowing them to thrive in the international digital economy.

In crafting a hassle-free guide to global payment solutions for African remote talent, the goal is not just to address the immediate need for transactional ease. It’s about empowering a new generation of workers with the knowledge and tools they need to harness their full potential, break down barriers, and build a prosperous and sustainable career in the remote work landscape.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.