Managing payroll is one of the most critical yet complex responsibilities for small businesses. It’s not just about issuing salaries; it involves tracking time, applying deductions, calculating taxes, and staying compliant with ever-changing regulations. For many small business owners, especially those without a dedicated HR department, payroll quickly turns from a routine task into a source of stress.

Manual payroll processes or basic tools may work in the early days, but they rarely scale. Errors, delays, and compliance risks can snowball into costly penalties, employee dissatisfaction, and loss of credibility. That’s why small businesses need a payroll system that is accurate, automated, and built for growth.

In this article, we’ll explore why Loubby AI is the smart payroll solution for small businesses and how it reduces errors, streamlines operations, and ensures compliance, all while supporting long-term scalability.

Why Small Businesses Need a Smart Payroll Solution

Small businesses face payroll challenges that are both unique and high-stakes. Unlike large enterprises with dedicated HR and finance departments, small business owners and their lean teams often wear multiple hats—handling sales, operations, customer service, and administrative duties all at once. When payroll is added to the already full plate, the process can quickly become overwhelming. It’s not just about issuing paychecks; it’s about navigating tax regulations, tracking employee hours, applying the right deductions, and maintaining detailed records for compliance.

In environments where time and resources are limited, even a small payroll error like miscalculating deductions or missing a tax filing deadline can trigger a chain reaction. The result might be a delayed salary, a compliance fine, or worse, lost trust from employees. These aren’t minor setbacks for a small business; they’re disruptions that impact morale, productivity, and financial stability.

That’s why relying on manual methods or outdated software simply isn’t sustainable. Upgrading to a smart payroll system isn’t just a nice to have. It’s essential for operational efficiency, risk reduction, and building a workplace culture rooted in reliability and trust.

1. Time Savings

Automating payroll processes such as payroll calculations, tax deductions, and direct deposits, streamlines routine tasks that would typically require significant time and effort. This means business owners and HR teams no longer need to spend countless hours on manual calculations and paperwork. With these processes handled efficiently by a payroll system, business leaders can shift their focus toward more strategic initiatives, like expanding their product offerings, driving sales, and fostering growth.

2. Error Reduction

Handling payroll manually is prone to human error. Common mistakes such as incorrect wage calculations, misclassifications of employees (e.g., exempt vs. non-exempt), or missed tax deductions can lead to serious consequences. A payroll system, like Loubby AI, automates these tasks with a high level of precision, greatly reducing the risk of errors. This ensures that employees are paid accurately and on time, while businesses avoid costly mistakes that could result in penalties or reputational damage.

3. Compliance Assurance

Navigating payroll tax regulations can be complex and time-consuming, especially when tax rules vary by region and are subject to frequent changes. Staying up-to-date with these shifts is crucial for avoiding compliance issues and potential fines. A robust payroll solution, such as Loubby AI, helps businesses stay compliant by automatically updating tax regulations and ensuring that all calculations are in line with the latest requirements. This minimizes the likelihood of facing audits or penalties for non-compliance.

4. Employee Satisfaction

When employees are paid correctly and on time, it creates a sense of reliability and trust in the employer. Payroll issues, such as delayed payments or incorrect amounts, can cause frustration and reduce overall job satisfaction. By automating payroll with a solution like Loubby AI, businesses can ensure that employees are consistently paid on schedule and in the right amounts, leading to improved morale, greater trust in the company, and enhanced retention rates.

5. Cost Efficiency

Payroll can be a significant expense for businesses, particularly when third-party services are employed to manage it. Outsourcing payroll can lead to ongoing costs and additional administrative overhead. By automating payroll processes through a system like Loubby AI, businesses can eliminate these external fees and reduce internal administrative costs. In the long run, this contributes to a more cost-efficient operation while maintaining accuracy and compliance.

6. Scalability

As businesses expand, the complexity of managing payroll increases. More employees, varying job roles, and changing payroll requirements can quickly overwhelm traditional payroll systems. A scalable solution like Loubby AI allows businesses to manage payroll seamlessly, even as they grow. Whether a company hires additional staff or expands into new regions, Loubby AI adjusts to these changes effortlessly, ensuring smooth and efficient payroll management without disrupting daily operations.

What Makes Loubby AI the Best Payroll Solution for Small Businesses?

Loubby AI goes beyond traditional payroll software by offering an AI-powered, integrated HR and workforce management system that is well-suited for small businesses, among others. Its flexibility, automation, and compliance features make it a strong payroll solution for companies of all sizes, including startups and growing teams that need efficiency without the complexity of enterprise systems. Here’s why it stands out as one of the best payroll solutions available:

1. Automated Payroll Processing

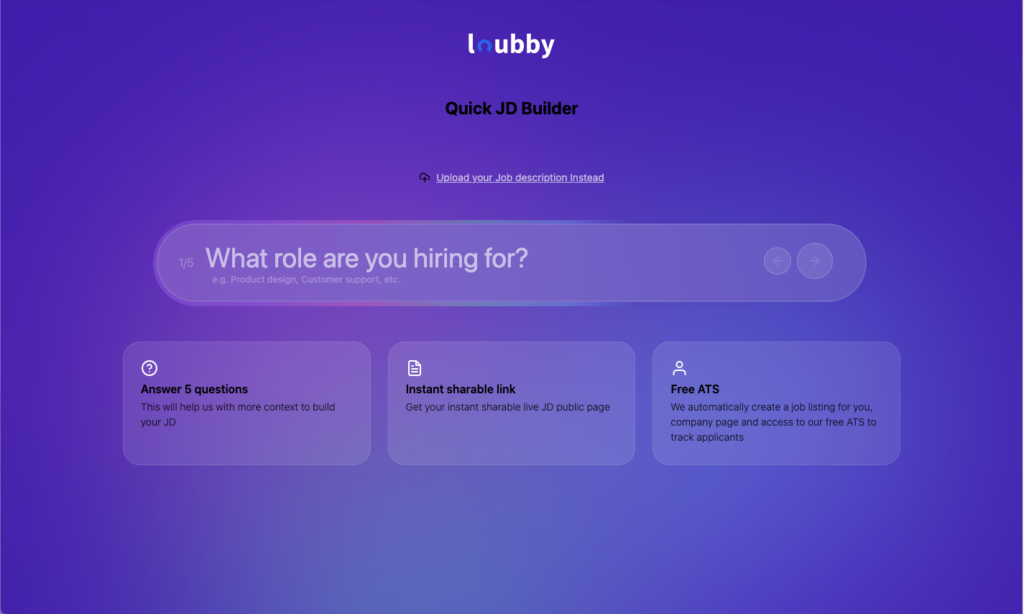

Loubby AI eliminates the complexity of manual payroll by fully automating the entire process. Whether your business employs hourly workers, salaried professionals, or independent contractors, the platform ensures accurate and timely salary payments. It automatically calculates regular wages, overtime, bonuses, and deductions, significantly reducing the risk of errors. Payslips and required tax documents are generated seamlessly without manual input, and the system supports a variety of payroll schedules, including weekly, biweekly, and monthly cycles.

2. Built-in Tax Compliance and Deductions

Payroll tax compliance is one of the most complex challenges for small businesses. Tax laws differ by location and are frequently updated, making it difficult to stay current without a dedicated compliance team. Loubby AI simplifies this process by automatically calculating local, state, and federal payroll taxes using real-time updates, ensuring every payroll run aligns with the latest regulations.

In addition to tax calculations, the platform handles all statutory deductions, including health insurance, pension contributions, and wage garnishments. It also generates tax reports and filing documents, making it easier for businesses to submit accurate returns and avoid penalties. By embedding compliance logic into the system and updating it regularly, Loubby AI eliminates the need for manual tax tracking and reduces the risk of filing errors.

3. Seamless Employee Payments

Loubby AI simplifies payroll disbursement by giving employers flexible tools to manage payments securely and efficiently. Through the platform, employers can initiate payments using direct deposit, bank transfers, or digital wallets. This ensures that wages, bonuses, and contractor fees are delivered quickly and reliably, without relying on third-party processors or waiting for bank clearance.

For employees, Loubby AI enhances the payroll experience through a dedicated self-service portal. Employees can log in to view their payslips, download tax documents, and review their payment history at any time without needing to contact HR. This level of transparency builds trust, empowers employees to track their financial records independently, and significantly reduces administrative workload.

By automating the payroll distribution process and removing the need for manual follow-ups, Loubby AI helps small businesses maintain accuracy, reduce overhead, and ensure a seamless payroll experience for all parties involved.

4. Payroll Smart Wallet

Among the standout features of Loubby AI is the Payroll Smart Wallet, a sophisticated yet intuitive tool designed specifically for business owners and managers. Unlike conventional payroll systems that rely on traditional banking processes, the Smart Wallet enables instant, secure, and flexible payroll funding and disbursement. Acting as a centralized payroll command center, it allows employers to pre-fund payroll accounts, schedule payments in advance, and instantly disburse salaries, bonuses, or contractor fees. Its real-time functionality eliminates delays caused by banking timelines or third-party processors. Additionally, the platform includes robust reporting and audit tools, providing detailed tracking and full oversight of every payroll transaction.

Integrated Workforce Management

Unlike standalone payroll solutions, Loubby AI offers an integrated workforce management platform combining payroll processing with comprehensive HR management features. Its integrated time tracking and attendance functionality ensures precise payroll calculations by automatically capturing employee working hours and attendance data. The performance management module seamlessly aligns payroll with employee performance metrics, simplifying calculations of bonuses and incentives. Additionally, the expense management feature streamlines employee expense tracking and reimbursements directly through payroll. The leave management system automates all leave-related calculations, accurately adjusting payroll deductions based on employee absences or benefit entitlements. Together, these integrated features significantly enhance payroll accuracy and improve administrative efficiency.

6. Scalability and Growth-Focused Features

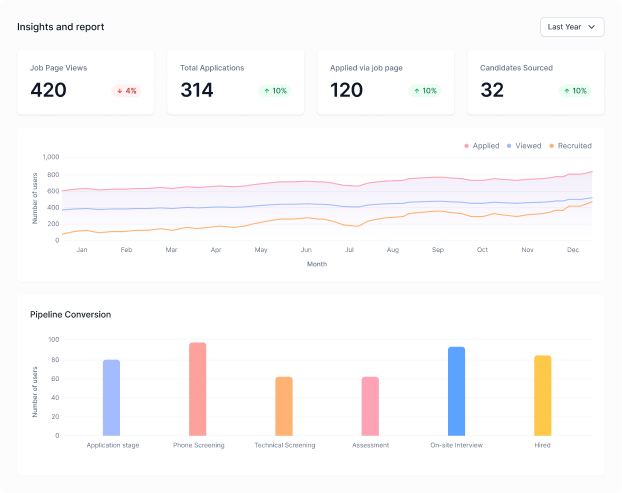

Designed with growth in mind, Loubby AI easily scales alongside your business. Whether you’re hiring your very first employee or rapidly expanding your workforce, the payroll system effortlessly adapts to your evolving needs. It provides reliable payroll processing capabilities suitable for businesses at all stages; from emerging startups to established enterprises. Adding new hires, remote workers, or independent contractors is simple and straightforward. Furthermore, Loubby AI utilizes advanced AI-driven insights and analytics, enabling business leaders to optimize payroll costs, enhance workforce productivity, and make informed strategic decisions to support ongoing growth.

Conclusion

Small businesses can’t afford payroll mistakes, outdated tools, or slow processes. They need a system that is fast, accurate, compliant, and built to scale with them. Loubby AI delivers all of that and more.

With automated payroll runs, real-time tax updates, flexible payment options, and integrated workforce tools, Loubby AI turns payroll from a burden into a strategic advantage. It helps business owners stay compliant, boost employee satisfaction, and reclaim time for high-impact work.

If you’re ready to simplify payroll and future-proof your HR operations, schedule a demo today and discover how Loubby AI can transform payroll for your business.